Ninepoint Energy Fund

How can one of the most lucrative investment opportunities in decades stare investors in the face and yet month after month energy stocks have continued to languish while the market’s focus stubbornly remains on other areas like bitcoin, marijuana stocks, and the general tech space leading to an unintentional shunning of the energy sector?

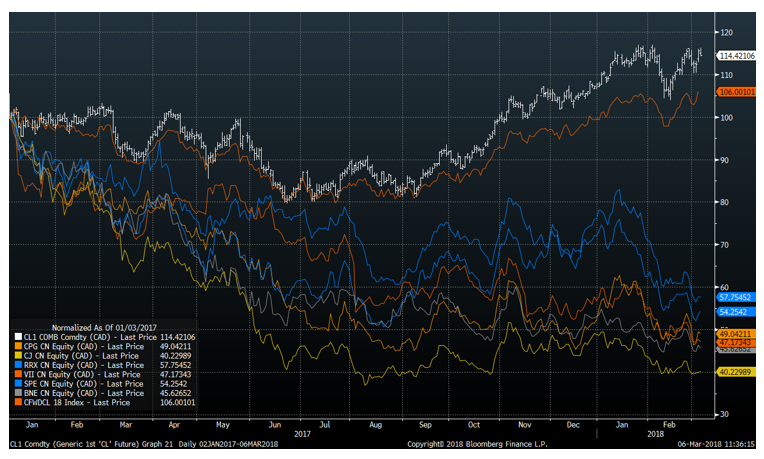

Every morning on CNBC and BNN significantly more airtime is given to discussing in-vogue names like Amazon or Canopy Growth than the $2.3 trillion oil market or the energy stocks which have dislocated from the price of oil by the greatest extent in history while oil trades at multi-year highs (see below…oil spot/strip price in CAD$ terms is up 14%/6% since the beginning of 2017 and many Canadian oil stocks are down 50%-60% over the same time frame = 65%+ relative underperformance!!!).

What makes this lack of interest (and commensurate lack of investment flow) so frustrating? It is that the current macro backdrop for oil is overwhelmingly positive in addition to our belief that oil is in a multi-year bull market with few things capable of interrupting this reality. Why can’t everyone see what we see?

1. Oil is trading near a 4 year high

Source: Bloomberg

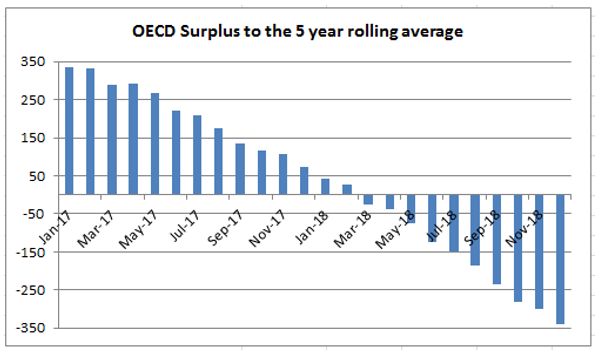

2. The “oil glut” (ie. OECD surplus oil inventories to the rolling 5 year average) has fallen from 334MM Bbls as of January 2017 to a now ~26MM Bbl deficit and this number could swell to a deficit of more than 300MM Bbls by the end of 2018.

Source: Ninepoint Partners

3. OPEC and Russia have pledged that their 1.2MM Bbl/d cut will continue throughout 2018 and their compliance to the cut has been impressively strong, consistently exceeding 100%. Even if they are lying and all of the shut-in production were to come online TODAY the market would be back to an undersupplied scenario by the end of 2018 (this is not well understood).

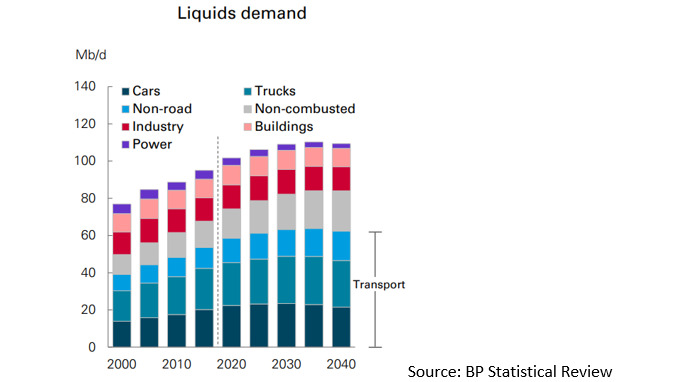

4. Oil demand is rocking with 2017 demand up ~1.7MM Bbl/d and 2018 looking to be an even stronger year with some firms like Goldman Sachs calling for growth to exceed 2MM Bbl/d.

5. The big boogeyman in the room, US shale, will not grow as quickly as people believe and will be limited to ~1.2MM Bbl/d. This is due to an incredibly important and yet still under appreciated shift in management mindset (and incentive plans with 60%-70% of companies adopting returns based incentive plan in 2018, up from 10% in 2015) to generating acceptable economic rates of return versus absolute production growth (aka “growth for growth’s sake”). In addition, infrastructure, labour, and equipment shortages all are acting as further anchors to growth potential.

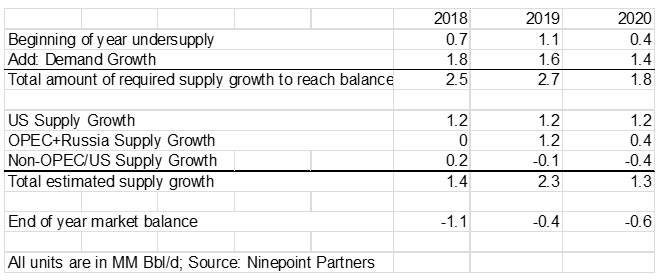

6. The oil market in 2017 was undersupplied by 0.7MM Bbl/d (as evidenced by inventory drawdowns at the fastest pace in history). When combined with demand growth of 1.8MM Bbl/d this means that supply would have to grow by 2.5MM Bbl/d in 2018 to reach balance. With US production constrained to about 1.2MM Bbl/d, flat OPEC and Russia production, and non-OPEC/US production to be up about 0.2MM Bbl/d it should remain obvious that the market will remain undersupplied. The last time OECD inventories reached our 2018 projected levels of sub 2.6BN Bbls the price of oil (WTI) was above $70/bbl.

Given all of the above it should be obvious that the current backdrop for oil is universally positive. It isn’t just a short term bullish call but rather one that extends over the next 4-5+ years. Why do we believe we are in a multi-year long bull market for oil? There are 4 primary reasons and they all point to a market that should remain undersupplied for the next several years (even as US shale continues to grow and OPEC volumes come back onto the market in 2019) and suggest that oil will have to rally high enough to rationalize demand growth lest inventories fall to dangerously low levels:

1. US supply growth is likely limited to ~1.2MM Bbl/d per year due to the reasons explained above.

2. OPEC supply – which once post the 1.2MM Bbl/d of shut-in volumes being returned to the market will be largely producing at near peak production levels for the next several years offering limited net aggregate growth potential.

3. Demand is likely to grow by at least 1.2-1.5MM Bbl/d for the next several years barring a global recession, given demand trends in both OECD and non-OECD countries.

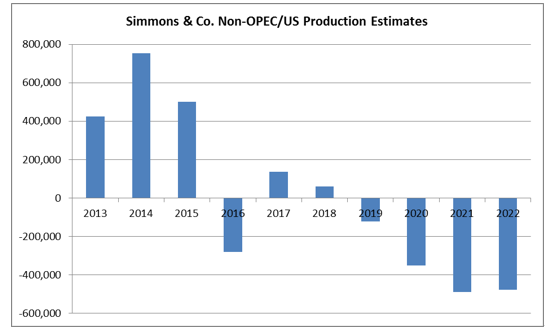

4. Most importantly, non-OPEC/US production is set to go into a multi-year decline in 2019 given the largest decrease in spending on long-lead (4-6+ years) in history.

Source: Simmons

The summary of these 4 main factors is in the below table and shows that even with tapering oil demand growth rates, ongoing US supply growth, and OPEC bringing back online all 1.2MM Bbl/d of shut-in volumes that the oil market should remain undersupplied for at least the next several years:

Given the fixed nature of US/OPEC growth rates and the very long-lead nature of non-OPEC/US mega-projects (4-6+ years) we believe the global oil supply chain lacks the ability to respond to the coming shortage. As a result, the price of oil beginning in 2019 and increasingly in 2020 will need to act as a demand-rationalizing mechanism which suggests that the oil price will have to increase meaningfully higher than today’s price level.

No Comments